Maintenance value and the corresponding compensation, typically designated as “Supplemental Rent”, “Reserves”, or “End of Lease Compensation” within a lease agreement, contribute an essential element of value and liquidity within an Asset Backed Securitization (ABS) portfolio.

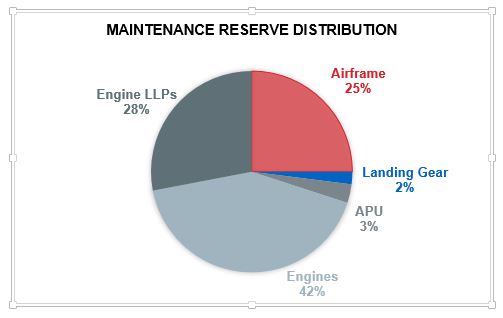

In an aircraft lease, lessors collect maintenance compensation for utilization on the individual components on each aircraft. These typically include the airframe, landing gear, auxiliary power unit (APU), engines, and engine life limited parts (LLPS). The chart below depicts a typical distribution of monthly maintenance reserves over each component, determined by cost and approximate interval of each relevant maintenance item on an A320-200.

Within an ABS deal, maintenance compensation collected from the lessees is funded into an aggregate Maintenance Support Account. Whereas typical leases will divide reserves into individual accounts to be drawn down at the time each component undergoes maintenance, the Maintenance Support Account is used to reimburse all future maintenance events for the assets in the portfolio, and is only required to have funding over a predetermined “look-ahead period”, typically 12 months.

In addition to supplementing cash flows in a portfolio, maintenance adjustments, as calculated by the cost of a maintenance event and the position of the aircraft in its maintenance life cycle, are applied to each aircraft’s Base Value. The maintenance adjusted values are then used to assess the overall value of the collateral pool and determine the loan-to-value (LTV) on each tranche of issuance.

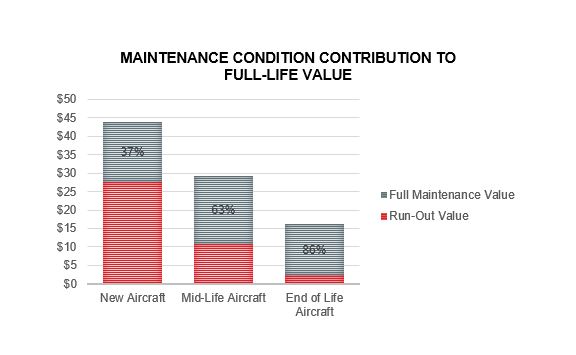

As an aircraft ages, the overall value of the asset depreciates. However, the cost to perform maintenance on each of its components increases over time with inflation. Therefore, as the asset ages, the inherent value of maintenance in the aircraft becomes a larger portion of its overall value.

Based on the full life market value and the full maintenance value of the components on an aircraft, an approximate run-out value on each vintage of the aircraft can be derived. The maintenance value to full-life value ratio illustrates how the value of maintenance in an aircraft encompasses a larger factor of the asset’s total value over time. The example below is an estimation of the reinvestment needed to bring an A320-200 back to full-life conditions.

As a result of the dynamic between aircraft depreciation and maintenance appreciation, we find two immediate impacts on ABS transactions over time: First, the inherent maintenance value become a larger component of each aircraft’s value and therefore the overall collateral pool. Second, as lease rates decrease with the decline in overall asset value, the maintenance-related cash flows become an increasing portion of the ABS’s liquidity.