737-800 Passenger and Converted Freighter Lease Rates

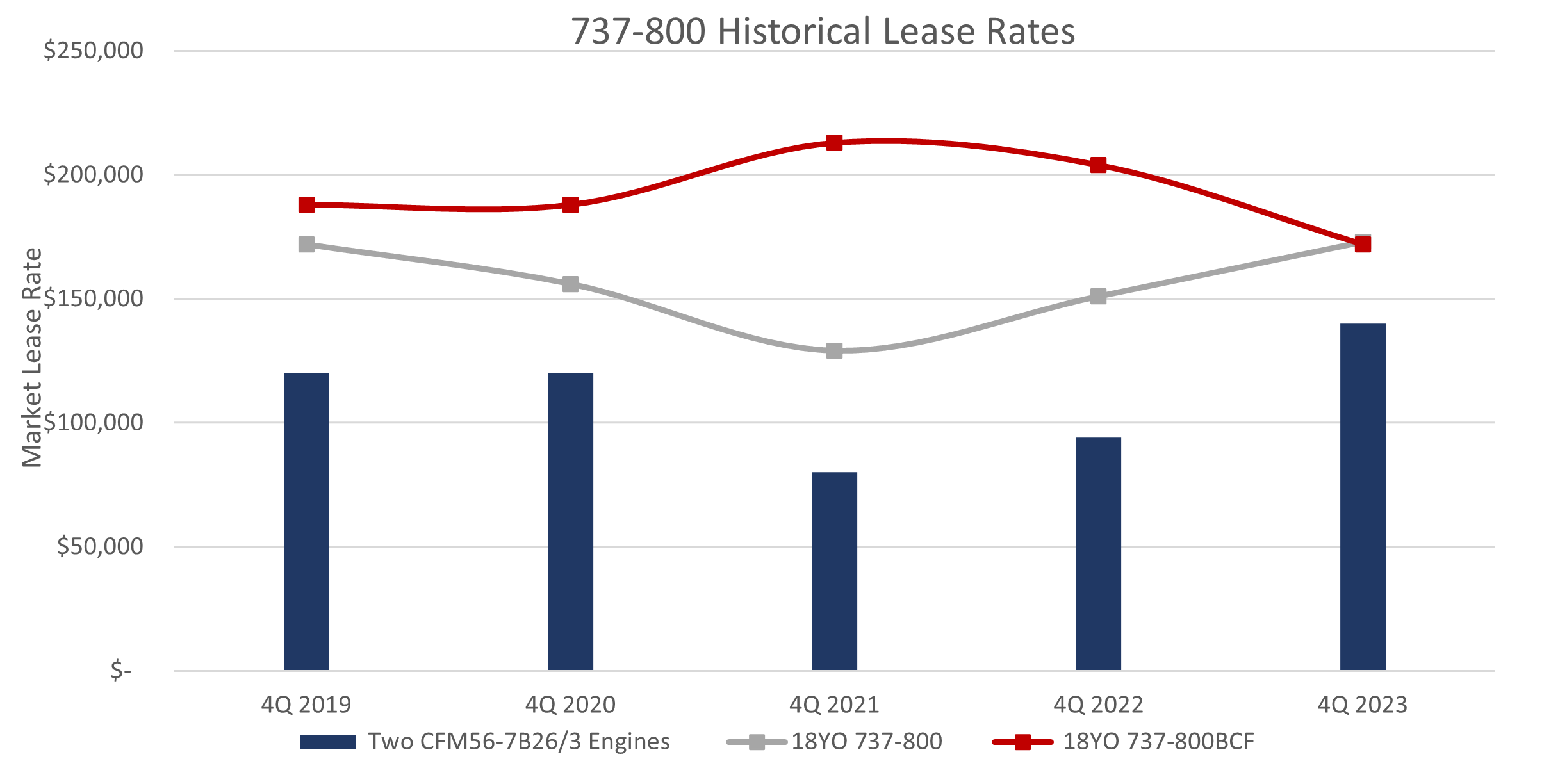

Throughout the pandemic, lease rates for 737-800 passenger and converted freighters experienced a substantial divergence due to the simultaneous increase in demand for air freight and severe drop in domestic travel demand stemming from COVID-induced lockdowns. Market Lease Rates fell 25.0% for 18-year-old 737-800s between 4Q 2019 and 4Q 2021, while they increased 13.3% for 18-year-old 737-800BCFs in the same period. However, Market Lease Rates for both types are crossing over in 4Q 2023, as the air freight and domestic passenger travel markets have flipped. Air freight demand is now contracting from 2021 highs, and domestic travel demand has fully recovered, surpassing 2019 highs. mba expects lease rates for both 737-800 passenger aircraft and CMF56-7B engines to continue to strengthen in the near term due to capacity constraints caused by ongoing delivery delays and new tech engine issues that are forcing operators to source aircraft and spare engines in the secondary market.

Given the US$5m conversion cost for 737-800 and the limited availability of the desired freighter engine build, the current lease rate imbalance will likely deter investors from converting feedstock and instead deploy the assets in the passenger space. Similarly, the engine market is becoming exceedingly attractive, with CFM56-7B lease rates escalating above $70,000/month, plus reserves. Further, lease rates for the freighter are expected to remain soft in the near term, while passenger rates are expected to continue to strengthen. While the imbalance is currently favoring the passenger space, this may become beneficial to the freighter fleet values over time. In the mid to long term, the dichotomy between the two is expected to return to freighter premiums over the passenger, especially if conversions slow down in a market primed for replacement within the next decade.